How to Price Your Product Without Guessing

- Dec 17, 2025

- 11 min read

Pricing feels like a high-stakes guessing game. You’ve looked at what your competitors charge. You’ve thought about your costs. But there’s still that nagging feeling in your gut: “Did I get this wrong?” Is the price too high? Too low? Will people see the value, or will they scroll past?

If this feels familiar, you’re not going crazy. It makes sense that you feel stuck. Pricing is one of the hardest things to get right, especially when most advice is either too generic or too academic to be useful. The problem isn’t that you’re bad at this; it’s that you haven’t been given a clear way to think about it.

This guide gives you a way to think. It’s a straightforward method for using market-based pricing to bring structure and confidence to your decision. We’ll skip the jargon and focus on how to find a price that’s anchored in reality, not just wishful thinking.

What Market-Based Pricing Really Is (and Why It Helps)

Feeling stuck on pricing usually means you're looking in the wrong place for answers. Most founders start by looking inward at their costs, but for a service or software business, that’s a dead end. How do you put a price on two years of development?

Market-based pricing forces you to look outward.

Instead of starting with your own spreadsheets, you start by understanding the world your customer already lives in. What are your competitors charging? What do customers in your industry expect to pay? It’s about setting your price based on what the market will accept.

Think of it like selling a house. You might have spent a fortune on the kitchen, but the final price is always shaped by what similar houses are selling for in your suburb. Your costs are part of the story, but the market writes the ending.

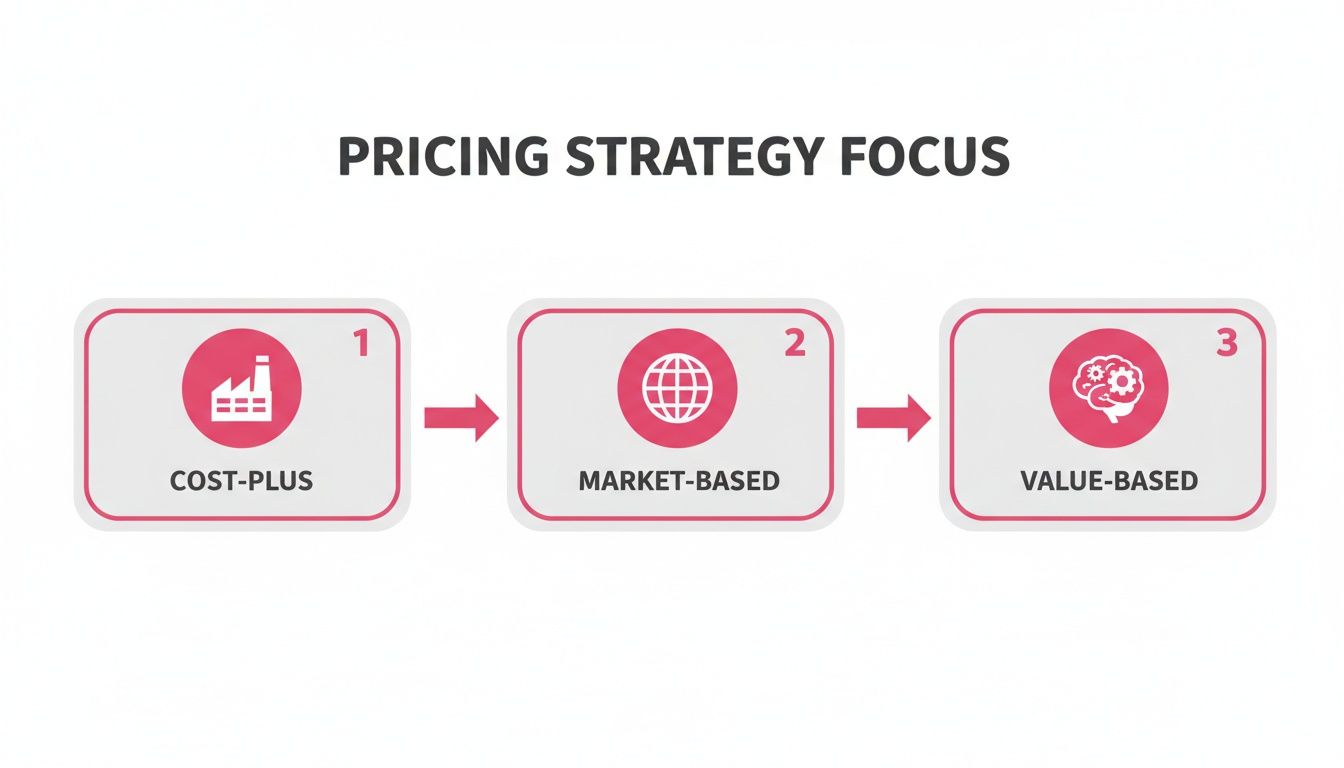

A Quick Look at the Three Pricing Models

To get your bearings, it helps to see where market-based pricing fits. There are really only three ways to think about price.

Pricing Method | Focus | Best For | Potential Pitfall |

|---|---|---|---|

Cost-Plus Pricing | Internal Costs | Physical products with clear, repeatable production costs. | Completely ignores what customers are willing to pay and what competitors charge. |

Value-Based Pricing | Customer's Perceived Value | Highly specialised or unique solutions with a very clear, quantifiable ROI. | It can be incredibly difficult to measure and often requires deep, ongoing customer research. |

Market-Based Pricing | External Market Conditions | Competitive industries (like SaaS or professional services) where customers have options. | Risks creating a "race to the bottom" if you don't have a clear point of difference. |

Most strong businesses blend these ideas, but market-based pricing is the most practical place to start. It gives you a solid foundation based on the real world, not theory.

Why It’s a Lifeline for Scaling Companies

Let's imagine a founder launching a new agtech platform. She could try a cost-plus approach, but how do you price years of R&D into a monthly subscription? It’s impossible. She could try value-based pricing, but the "value" is very different for a small family farm than for a massive corporate operation. It's too subjective.

A market-based approach gives her immediate clarity and direction.

It creates a benchmark: She can look at what similar farm management tools charge. This instantly gives her a logical price range to work within.

It meets customer expectations: Farmers already have a price in their head based on other software they use. Aligning with that reduces friction in the sales process.

It shows where you're different: By seeing what competitors charge for certain features, she can spot gaps. Maybe they all charge extra for something she can include as standard, justifying her price.

Market-based pricing isn’t about copying your competitors. It's about understanding the context they’ve created in the customer's mind, then deciding how you want to position your business within it.

This approach brings structure to a messy process. It shifts your focus from "What did this cost me to build?" to the far more important question, "Where do we fit in our customers' world?" This is a core part of building a market entry strategy that gives you confidence and momentum.

How to Audit Your Market Without Getting Overwhelmed

The idea of a ‘market audit’ sounds heavy. It brings to mind huge spreadsheets and weeks of analysis. This is where most founders get paralysed, feeling they don’t have enough data to make a good call.

You don’t need a mountain of information. You need the right information, organised in a way that gives you clarity.

The chaos of market analysis stems from the lack of a system. When we embed with a team, one of the first things we do is bring structure to this exact problem - turning a messy pile of competitor links and random customer notes into a clear picture.

You can do this yourself. Forget trying to know everything. A focused audit examines only three things: competitor pricing, customer perception, and broader market trends.

Deconstruct Your Competitors' Pricing

First, look past the headline price on your competitors’ websites. You need to decode what they’re really telling customers. This isn't about copying; it's about understanding the environment your customers are in. Map out your top three to four direct competitors. For each one, note:

Their Pricing Tiers: What do they call their plans (e.g., Starter, Pro)? This tells you how they segment their customers.

What They Charge For: As the price goes up, what is the main thing that changes? Is it more users, specific features, or more support? This reveals what they believe is most valuable.

The Language They Use: How do they justify their price? Do they talk about saving time, increasing revenue, or reducing risk? This is how they frame their value.

This simple exercise gives you a clear snapshot of the pricing norms in your space. It creates a baseline for what customers expect and shows you where you can position yourself differently.

As you can see, a market-based approach acts as a bridge, connecting your internal numbers to the reality of customer value and competitor actions.

Understand What Customers Think Is Fair

Next, get a sense of what your target audience considers a reasonable price. Many founders are afraid to talk about money, but you can get great insights without ever asking, "What would you pay for this?"

The key is to understand their existing reference points. This is a core part of good target audience research, and it doesn’t have to be complex.

During conversations with potential customers, ask questions like:

"What are you currently using to solve this problem?"

"Roughly what does that cost you?"

"Is that a one-off payment, or a subscription?"

Their answers give you a 'price anchor' - a number that already exists in their mind. Your price will be judged against this anchor, whether you know it or not. Finding it gives you control over the conversation.

You only need five to ten of these chats to see a pattern. You’re not looking for a single number; you’re looking for a ballpark that represents the value of solving the problem you address.

Keep an Eye on Market Trends

Finally, remember your price doesn't exist in a vacuum. Broader economic shifts play a role. You don’t need to become an economist, but a general sense of the market provides vital context.

For example, data from Australia's Producer Price Indexes (PPIs) shows how producers react to market pressure. In one period, the price of ready-mixed concrete fell by 1.3% simply because of increased competition - a perfect example of external forces driving price changes.

For your business, this might mean looking at:

Industry Health: Is your target market growing or shrinking?

Technology Shifts: Is a new technology making older solutions less valuable?

Regulatory Changes: Are new laws creating new costs or opportunities for your customers?

A quick read of industry news sites once a month is enough. The goal is to avoid being surprised by a major shift, giving you confidence your pricing is built on a solid foundation.

A Practical Example: From Stuck to Confident

Theory is fine, but let's make this real.

Meet Sarah. She’s built an incredible inventory management tool for small wineries. She knows the product is solid, but she's completely frozen on pricing.

Cost-plus pricing is useless; her main costs are sunk development hours. Value-based pricing is too abstract; the "value" differs between a boutique vineyard and a larger operation.

She’s trapped in that classic founder paralysis: feeling the pressure to decide, but having no logical way to do it. This is where a market-based approach gives her a clear path.

A Simple, Three-Step Playbook

Instead of staring at a blank spreadsheet, Sarah takes three focused steps.

She maps the competitive landscape. She identifies her three main competitors and builds a simple chart. She notes their prices, but more importantly, she digs into what they charge for. She quickly discovers they all charge extra for integrations with accounting software. This is a crucial insight.

She talks to potential customers. She has five conversations with winery owners. She avoids the useless question, "What would you pay?" and instead asks, "What are you using for inventory now, and what does that cost you?" This grounds the discussion in real budgets.

She finds a gap. During her research, she notices none of her competitors offer good mobile access for stocktakes out in the cellar. It's a common frustration she hears in her calls, but no one seems to be solving it well.

This is where market-based pricing shifts from being reactive to being strategic. It’s not about being the cheapest. It’s about becoming the clearest and best choice for a specific type of customer.

Setting a Price With Confidence

Armed with this information, Sarah finally has the structure she was missing. She decides to price her software in the middle of her competitors, but with one key difference: she includes the accounting integration and a best-in-class mobile app as standard features in her core plan.

Suddenly, her pricing tells a powerful story. She’s not just another option; she's the obvious choice for modern wineries that need flexibility.

This process shows how market-based pricing turns messy theory into a practical playbook. It’s a system for gathering real-world evidence that builds the confidence to make one of your most critical decisions.

You can see the same principles at work in larger markets. Look at the Australian property market. After a downturn, low interest rates and tight supply caused a major recovery. By December 2024, median house values jumped by 7.53% year-on-year, driven entirely by demand outstripping supply. It’s a massive example of how market dynamics set prices. You can read more about these property market trends and their drivers.

Sarah’s story isn't about a complex framework. It’s about a simple shift in thinking - from internal guesswork to an external, evidence-based strategy that provides clarity, direction, and momentum.

Setting and Testing Your Price Bands

After your research, it’s tempting to pick a single price and hope for the best. Don’t do it. A single price is a guess, and if you guess wrong, you’re stuck.

A smarter approach is to think in terms of a range. This is your price band - a floor and a ceiling for your offer. It’s a small mental shift that moves you from a rigid position to a flexible one. It gives you room to test your ideas without being locked into a price that might not work.

Finding Your Floor and Ceiling

Your price band isn’t arbitrary. It’s grounded in the market audit you just did, giving you a logical range to work within.

The Floor: This is the absolute minimum you can charge. It isn't just about covering your costs; it's the lowest price that still positions you as a credible, professional solution. Go below this, and you risk looking cheap.

The Ceiling: This is the highest price the market seems willing to pay for what you deliver, based on your competitor analysis and customer conversations. Push past this without a very clear, powerful reason, and you'll get a lot of "no's".

This idea of a dynamic price band is everywhere. In Australia's National Electricity Market (NEM), wholesale prices are reset every five minutes based on supply and demand. In March 2023, the price in Victoria was around $60/MWh, while in NSW it was closer to $100/MWh - all because of different market conditions. You can read more about these dynamic energy market prices and what drives them.

How to Test Your Price Without Complicating Things

Once you have your band, you need to test it. This doesn’t require complex A/B testing software. Early on, you can get the data you need with simple methods.

A quick experiment can bring enormous clarity. Instead of locking in a price for a year, you can learn what you need to in a few weeks.

The goal isn’t to find the one “perfect” price. It’s to understand how different price points change the conversation.

Here are a couple of practical ways to start:

Use Different Prices in Sales Conversations: This is the simplest test. With one prospect, quote a price near your ceiling. With the next offer, one closer to your floor. Don’t ask them what they think - watch their reaction. Do they flinch? Do they ask more questions about value? Or do they accept it easily? Their response is pure gold.

Test the Justification, Not the Number: Create two versions of your proposal template. The price is the same, but the justification is different. One version might focus on "saving 10 hours a week," while another focuses on "reducing project risk by 50%." Pay attention to which one gets a better response.

By treating your price as something that can evolve, you turn a stressful decision into an ongoing learning process. This builds confidence and ensures your pricing stays relevant.

Your Next Step: Don't Overhaul Everything

If all this feels like a lot, that’s normal. It’s easy to read a guide like this and feel even more behind than when you started. That feeling is your cue to simplify, not panic.

You do not need to tear down your entire pricing model overnight. The goal here is to build momentum, not create more chaos. Trying to fix everything at once is a surefire way to get stuck right back where you started: guessing.

Start with One Simple Habit

The single most useful thing you can do next is start a simple document to track your competitors. That’s it.

Open a document and list your top three or four rivals.

For each one, jot down:

Their main pricing tiers.

The price for each tier.

The top three features they highlight for each plan.

This will probably take you an hour. Then set a reminder to check it once a month. This simple act builds the habit of looking outward. Most pricing anxiety comes from being trapped in your own head. This small task grounds your thinking in the reality of the market.

This isn't about obsessively copying what your rivals do. It's about building a calm, structured understanding of the playing field. It replaces gut-feel guesswork with genuine awareness.

This is the kind of foundational work that brings immediate clarity. Most teams struggle because they’ve never had someone step in to structure this work. If you feel like your business is missing these core elements, our Foundations Fix sprint is designed to build this exact kind of structure and confidence, fast.

If this feels messy, that’s normal. You’re not behind. You need a system. Starting a simple competitor tracker is the best way to begin building that system today.

Common Questions About Market-Based Pricing

Even with a clear plan, a few questions always pop up. It’s that feeling of, "Okay, this makes sense, but what about my specific situation?" You're not alone.

Here are a few common questions we hear from founders, with straight answers.

What if My Product Is Completely New to the Market?

If you have no direct competitors, how can you use the market to set a price? You look at indirect competitors.

Your customers are doing something right now to solve the problem your product fixes. Maybe it’s a clunky spreadsheet, a manual process, or a different type of software. Figure out what those substitutes are costing them - in money, wasted time, and frustration. That gives you a powerful benchmark to anchor your price against.

How Often Should I Review My Price?

Pricing should never be "set and forget." For fast-moving industries like tech, a quarterly review is about right. It’s frequent enough to stay in sync with the market without giving your customers whiplash.

For more stable industries, every six or twelve months is fine. The key is to get into the habit of treating pricing as a living part of your business. This is the kind of system we help teams build so their pricing never gets stale or left behind.

Isn't This Just Copying Competitors?

No. This is the biggest misconception about market-based pricing. Thinking it’s just about mimicking others misses the entire point. You use competitor pricing as a single data point to inform your strategic position.

It’s not about copying your competitors' prices. It’s about being market-aware, not a market-follower.

A proper analysis helps you find the gaps - the places where you can offer more value, stand out, and justify a price that’s uniquely yours. It’s about using market data to make a smarter, more confident choice.