How to conduct competitor analysis when you don't know where to start

- Jan 3

- 12 min read

Trying to analyse your competitors can feel like staring at a messy, overwhelming map with no compass. You know you should be keeping an eye on them, but every attempt ends in a disorganised spreadsheet and a nagging feeling that you've completely missed the point.

If that sounds familiar, you’re not crazy. It makes sense that you feel stuck.

Most advice on this is painfully generic—"do a SWOT analysis" is a classic—but it rarely explains what to actually look for or how to turn your notes into a decision that helps your business. It leaves you feeling more confused than when you started.

This guide is different. We’re going to walk through a calm, structured approach designed to give you clarity and confidence, not add to the noise. The goal isn’t to obsessively spy on other companies; it’s to see the entire competitive landscape so clearly that your own path forward becomes obvious.

Most teams struggle here because they’ve never had a simple framework to follow. They get lost in the data and never find direction. We’ll fix that.

By the end of this, you’ll have a repeatable process that helps you truly understand:

Where you actually fit in the market.

Why customers should choose you over anyone else.

What your next move should be.

The real aim of competitor analysis is to stop guessing and start acting with purpose. It's the foundation for building a marketing strategy that works by making deliberate, informed choices instead of reactive ones.

Moving beyond ‘just looking’ at other companies

Randomly checking a competitor's website might feel productive, but it’s a reactive habit. It leads to copying features, mimicking messaging, and building a business that’s always a step behind. You end up looking and sounding like everyone else, leaving customers wondering why they should pick you.

This is especially risky in Australia’s tech and agtech sectors, where markets are becoming more concentrated. When a few dominant players emerge, a fuzzy market position can make you invisible. Research shows that between 2007 and 2020, the market share of the top four firms in the average Australian industry grew significantly. With over 30% of industries becoming more concentrated, just blending in is a bad plan. You can read more about the state of competition in Australia to see these shifts.

Proper competitor analysis isn’t about spying. It’s about understanding the market so you can find your unique, defensible space within it.

A small shift that changes everything

The point is to stop reacting and start acting with purpose. This means changing the questions you're asking. Instead of focusing on what your rivals are doing, you need to look at the market through your customer’s eyes.

This is usually where a sprint approach creates clarity quickly. It forces a change in perspective from:

“What are they doing?” to “What does the market need that they aren’t providing?”

“How can we match their features?” to “How can we solve the problem in a better way?”

“How can we get their customers?” to “How can we become the obvious choice for a specific type of customer?”

This small tweak in thinking changes everything. It moves you from a place of fear—of being left behind—to a place of opportunity.

When our team embeds with a client, this is the very first gap we work on closing. We bring the structure needed to move past surface-level observations and find the insights that lead to a confident, defensible market position. That shift gives you the direction you need to carve out your own territory.

How to identify your real competitors

Most founders only look at the obvious players—the companies selling a nearly identical product to the same audience. If you stop there, you’re missing most of the picture. Often, your most dangerous competitor is one you don’t even see.

An agtech company's biggest rival might not be another software platform. It could be the familiar spreadsheet a farm manager has used for the last decade. A B2B service business might lose a deal not to another agency, but to the client deciding to just hire someone in-house.

These are the hidden competitors that really shape the market. The goal is to move from just watching rivals to carving out a distinct space for yourself.

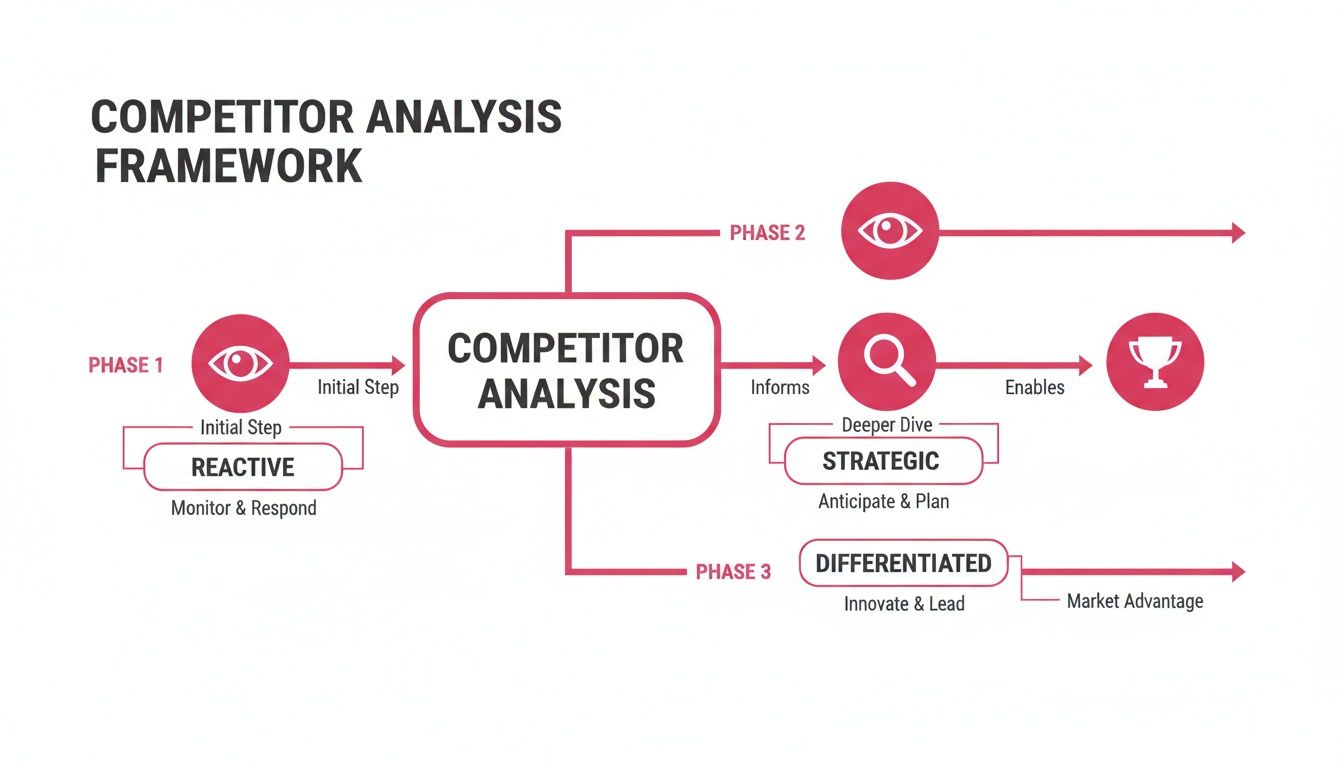

This journey from reactive to differentiated is where you find your real advantage.

The three types of competitors you actually face

To get a complete view, you need to think in three categories. Nailing this structure is the foundation for any analysis that gives you real direction.

Identifying Your True Competitors | ||

|---|---|---|

Competitor Type | Description | Example for a SaaS Business |

Direct | Businesses offering a near-identical solution to the same customer base. They’re the ones you’re compared to feature-for-feature. | Another project management tool with a similar price point and core functionality. |

Indirect | Companies solving the same core problem but with a different type of product. They’re competing for the same slice of your customer's budget. | A team communication platform like Slack or a shared document tool where project management happens informally. |

Substitute | The "good enough" workarounds, existing habits, or manual processes that stop a customer from buying any dedicated solution. | A shared spreadsheet, a collection of Word documents, or just deciding to "muddle through" without a specific tool. |

Once you see the landscape this way, it’s clear you’re not just fighting other companies; you’re often fighting inertia and old habits. Most marketing is built to fight direct competitors, but your customer is often comparing you to a substitute. If your message doesn’t explain why they need a real solution in the first place, you’ve already lost.

A practical example in B2B SaaS

Let’s say you run a SaaS business that helps marketing teams manage their content calendars. Using this framework, your competitive map suddenly looks much bigger:

Mapping the landscape this way changes how you think.

Suddenly, your marketing doesn’t just have to prove you’re better than the other calendar apps. It also has to convince a marketing manager that their trusty spreadsheet is costing them time and creating chaos. You have to make the case for a category of solution, not just your specific one.

This complete picture gives you confidence. It reveals the full range of arguments you need to make and helps you craft a message that resonates, no matter which alternative a customer is using. You finally have the structure needed to become the clear choice, not just another option.

The four key areas to focus your analysis

This is where most people get overwhelmed. They open a huge spreadsheet, start tracking dozens of metrics, and quickly drown in data with no real clarity.

The secret is to ignore most of the noise. Instead of documenting everything, you need a simple filter that forces you to focus only on the information that gives you a real advantage.

Almost everything you need to know about a competitor’s strategy boils down to four key areas: Positioning, Presence, Promotion, and Pricing.

This isn't about building a massive dossier on every rival. It’s about spotting patterns. This structured approach stops you from getting distracted and ensures you gather targeted information that leads to useful insights. It’s the kind of focus we bring into a business during a sprint to get to the heart of the problem, fast.

Positioning: how they explain their value

Positioning is the story a company tells the market about who they are for and why they matter. It’s the most important piece of the puzzle because it shapes every other decision they make. Your goal is to figure out that story.

Dig into their website and marketing materials. Pay close attention to the specific words they use to describe themselves, their customers, and the problems they solve.

Ask yourself:

Who do they claim to be for? Are they targeting a specific industry, company size, or user role? Look for phrases like "for startups," "built for enterprise teams," or "the choice for creative professionals."

What problem are they solving? Is their main focus on saving time, cutting costs, making more money, or simplifying something complex?

What is their core promise? Are they promising simplicity, power, affordability, or a premium service?

This gives you a deep understanding of where they see themselves in the market. Figuring out what brand positioning is and how to find yours becomes much easier when you can clearly see how others are carving out their own territory.

Presence: how they show up online

Presence is about how a competitor’s brand feels. It’s a mix of their visual identity, their website experience, and the overall confidence they project. This might sound subjective, but it has a huge impact on whether customers trust them.

Here’s what to look for:

Website Clarity: Can you figure out what they do and who it's for in five seconds? Is the navigation straightforward? A confusing website is often a sign of muddled thinking.

Brand Confidence: Does their design look professional, or is it dated and messy? Is their language clear and direct, or full of jargon?

Content Quality: Look at their blog or case studies. Is the content genuinely helpful, or does it feel thin and generic?

A confident digital presence signals a business that has clarity. A messy one often reveals a team that hasn't sorted out its own story yet.

Promotion: how they get attention

Promotion is about figuring out their main channels for finding customers. No business can be everywhere at once, so they have to make choices. Your job is to figure out what those choices are.

This shows you where they’re investing their time and money, and it can reveal gaps you can take advantage of. Don't track every social media post. Just look for the dominant patterns.

Focus on identifying their one or two primary channels:

Are they content-driven? A heavy focus on SEO, blogging, and webinars suggests they attract customers by being a trusted source of information.

Are they sales-driven? A prominent "Book a Demo" button and lots of sales-focused landing pages suggest a reliance on direct outreach.

Are they community-driven? An active user forum, events, or a strong social media following points to a community-based strategy.

Pricing: how they capture value

Finally, look at their pricing model. This isn’t just about the numbers; it’s about how they justify them. How a company prices its product says a lot about its confidence and its ideal customer.

Go to their pricing page and ask:

What's their model? Is it a monthly subscription, a per-user fee, or a one-off project cost?

What are the value metrics? Are they charging based on features, number of contacts, usage, or outcomes?

How do they frame it? Do they position themselves as the cheapest option, the best value, or the premium choice? The language they use for their tiers (e.g., "Basic" vs. "Growth") is a big clue.

By focusing your analysis on these four areas, you can build a clear picture without getting lost. It gives you the structure you need to turn simple observation into a calm, confident plan of action.

Turning your research into a clear action plan

You’ve done the research. The notes are there, you've mapped out the market, and you have a good sense of your competitors. This is the moment where most people stall. The research feels huge, and the path forward is anything but clear.

It’s normal to feel a bit lost here. You’re sitting on a mountain of information, but information alone doesn’t create momentum. The goal now is to translate that research into a handful of calm, confident next steps.

This is where structured work pays off. Instead of feeling overwhelmed, you can use your findings to create clarity. We’re going to distill everything into a simple summary that highlights your biggest opportunities, then turn those insights into a focused action plan you can start on next week.

Find the simple patterns

First, pull yourself out of the details. Stop looking at individual data points and start searching for the big patterns. The best way to do this is to answer three simple questions based on your research:

Where is the market crowded? Look for where everyone is saying and doing the same thing.

Where is there open space? Pinpoint the gaps. What customer needs are being ignored? What messages aren't getting through?

What are our most powerful advantages? Based on the gaps you’ve found, what unique strengths can you bring to the table?

This process is about moving from data collection to strategic thinking. It’s a crucial step that many teams skip because they’ve never had someone step in to structure the work. A solid analysis always highlights a clear path forward.

A practical example of insight to action

Let’s imagine a B2B consulting firm that helps construction companies with project management. After their analysis, they noticed a pattern: every competitor used dense, technical jargon on their websites. Their messaging was all about “optimising workflows” and “leveraging synergistic frameworks.”

Here’s how they turned that insight into an action plan:

The Crowded Space: The market was saturated with complex, corporate-sounding language that was likely alienating on-the-ground project managers.

The Open Space: There was a huge opportunity to just speak like a human. No competitor was using simple, direct language to connect with their customers’ real-world frustrations.

The Action Plan: They decided to build their entire marketing around clarity. Their next steps were simple: rewrite their website to be jargon-free, launch a blog series called "Project Management in Plain English," and change their sales pitch to focus on solving problems, not selling processes.

This is what turning research into action looks like. It’s not about doing a hundred things. It’s about finding the one strategic shift that changes everything.

From insights to a focused plan

Once you’ve identified your core opportunity, the final step is to break it down into a short, focused list of actions. Don't try to build a 12-month strategy. Think about what you can achieve in the next month.

For our B2B consulting firm, the action plan for their next marketing sprint might look like this:

Week 1: Rewrite the homepage and services page copy.

Week 2: Outline and write the first three articles for the "Plain English" blog series.

Week 3: Update the sales presentation deck with the new messaging.

Week 4: Create a social media plan to share the new content.

This approach transforms a daunting challenge into a manageable set of weekly tasks. It builds confidence and ensures your competitor analysis leads to real progress. If you want to dive deeper into this process, our guide on how to conduct market research that actually leads to a decision can provide even more structure.

If this process of turning research into action feels messy, that’s normal. You’re not behind. You just need structure. Start by summarising your findings into a simple list of opportunities and threats. That clarity alone will show you exactly what to do next.

Building a sustainable analysis habit

The market doesn’t stand still, so your understanding of it can’t either. Too often, founders treat competitor analysis like a huge project they tackle once a year. It produces a hefty report that no one reads and is out of date almost immediately. This is why so many people avoid it. It feels heavy and unproductive.

The goal isn’t to create an exhaustive dossier on every rival. It’s about building a light, regular habit—a simple pulse-check that keeps you in tune with the market. Shifting from a huge annual project to a sustainable quarterly review changes everything. It gives you the structure to adapt with purpose, not panic.

From project to process

The secret to making this manageable is to shrink the scope. You don't need to track ten competitors across fifty data points. You just need to focus on the vital signs.

A quick quarterly review of your top three competitors' positioning and marketing is infinitely more valuable than a deep dive every two years.

Here’s how to turn this into a light habit:

Put it in the calendar. Block out two hours at the start of each quarter and treat it as non-negotiable.

Look for big shifts. Don't get bogged down in details. Are there major changes to their core message, website homepage, or pricing model?

Use simple tools. Set up Google Alerts for your top competitors. This is an easy way to automate the process, bringing major news straight to your inbox.

This isn’t about obsessive spying; it’s about maintaining awareness. When we embed with a team, one of the first things we fix is this exact gap. A simple, repeatable process builds incredible confidence and stops you from relying on guesswork.

The real value comes from consistency, not intensity. A light, regular check-in creates a continuous feedback loop, ensuring your strategy stays relevant. If this feels messy, that’s normal. You’re not behind. You just need a simple, repeatable structure to lean on.

Still have questions about competitor analysis?

Even with a plan, a few questions always pop up. It's normal to feel hesitant when you first start. Let's tackle the most common roadblocks so you can move forward with confidence.

How much time should this really take?

Everyone worries this will become a massive research project that never ends. The reality is, it’s more about a consistent rhythm than a huge upfront effort.

I recommend starting with a focused deep dive. Set aside about 8-10 hours to build your first analysis. Once that’s done, you don't have to start from scratch ever again. A simple 1-2 hour check-in each quarter is all it takes to keep your finger on the pulse.

When we embed with teams, we build this lightweight process right into their workflow. The goal is to make it a clarifying habit, not another heavy task.

What if my competitors don’t show their pricing?

This happens all the time, especially in B2B. Don’t worry about it. Getting hung up on one missing piece of information is a classic way to lose momentum.

Instead, shift your focus to what you can see. There's a goldmine of information hiding in plain sight:

How do they talk about themselves? What's their core message?

Is their website clear and compelling, or confusing?

What topics are they writing about on their blog or social media?

What kind of jobs are they hiring for? (This is a huge tell!)

These clues tell a surprisingly detailed story about their strategy and where they're investing. Frankly, understanding how a competitor positions their value is often more revealing than knowing their exact price list.

The biggest mistake is thinking the goal is to copy what successful competitors are doing. It’s not. The whole point is to find your own path—one that's different and more compelling.

Use your analysis to spot the gaps they've left open or the customers they're ignoring. You’re looking for a way to be different, not a way to be the same. True confidence comes from knowing your place in the market is unique and defensible.

If this feels messy, that’s normal. You’re not behind. You just need structure. Before you touch anything else, just do one thing: identify your top three competitors across the direct, indirect, and substitute categories. That single step will give you the clarity you need to take the next one.

When you’re ready to stop guessing and build a marketing function that delivers real momentum, Sensoriium can help. We embed with your team to provide the clarity, structure, and direction needed to grow with confidence. Find out how we work.