How to Conduct Market Research That Actually Leads to a Decision

- Dec 28, 2025

- 15 min read

It usually starts with a simple question: "Is this a good idea?"

But that one question quickly fractures into dozens more. "Who would actually buy this?" "How much should we charge?" "Are we even solving the right problem?" Before you know it, you’re drowning in advice about surveys, focus groups, and data analysis, but none of it gives you a clear starting point.

If you feel stuck, knowing you need answers but not knowing which questions to ask first, you’re not going crazy. It’s a normal part of the process. It's a sign you need a clear framework, not more information.

Why Most Research Goes Nowhere

This is where most founders get stuck. They try to boil the ocean. They create an exhaustive list of everything they want to know, and the project becomes so massive that it never actually gets off the ground.

The pressure to get it "perfect" leads to paralysis. Teams end up falling back on gut feelings and assumptions simply because the research feels too big to tackle. When we embed with a team, this is often the first thing we fix. They have the right intentions, but are missing a simple structure to get moving.

The goal isn't to eliminate all uncertainty at once. It's to find one piece of information that gives you the confidence to make the next decision. That’s how you build real momentum.

This guide isn't another overwhelming checklist. It’s a practical, step-by-step approach to conducting market research that will turn that fog of uncertainty into a clear, confident path forward. We’ll start with one manageable step at a time.

Start With Your One Big Question

This is where most teams go wrong. They dive headfirst into "doing research" without a clear target and end up drowning in a sea of interesting but useless data. It feels productive, but it doesn't actually help you make a decision. That's why so many research projects die a quiet death as a forgotten slide deck.

Your job isn't to vaguely ‘learn about the market’. It's to find the answer to one critical business question that will unlock your very next move. Shifting from broad exploration to a focused mission changes everything. It gives you the structure you need to stop feeling overwhelmed.

From Fog to Focus: The Power of a Single Question

Without a specific objective, your research will meander. You’ll ask questions that are ‘nice to know’ but don’t force you to take action. The secret is to frame a question that demands a decision.

Just think about what's really holding you back right now. What single piece of information, if you had it, would make your next step obvious?

Is it: “Which customer segment feels the most acute pain from the problem we solve?”

Or maybe: “What specific feature is the key to winning our next 100 customers?”

It could even be: “How do our ideal customers describe their problem in their own words?”

See how specific those are? They aren't fuzzy queries like "What do our customers want?" They are targeted investigations designed to give you clarity and momentum. This is the first, most crucial step in learning how to conduct market research that actually gets results.

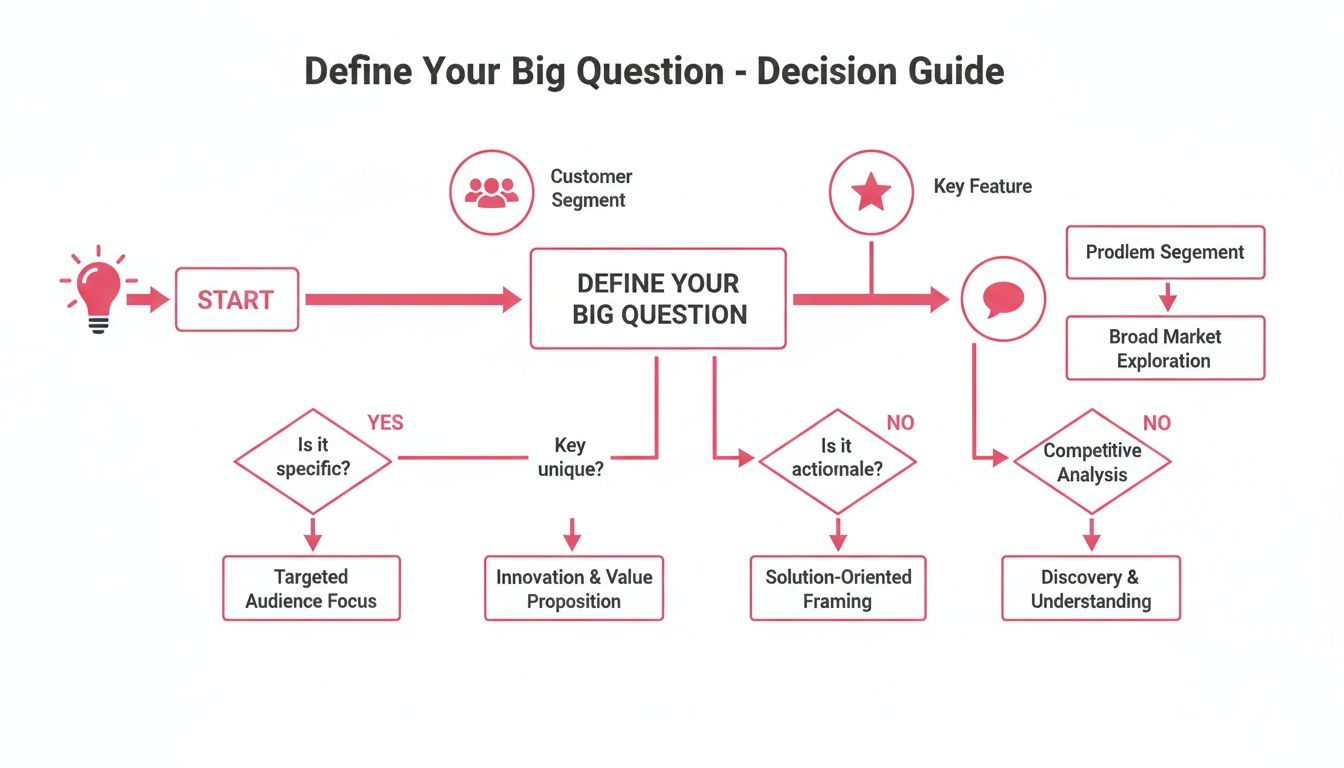

This process diagram lays out the traditional stages of market research, and you can see how everything hinges on a solid starting point.

Without a crystal-clear 'Problem Definition', your one big question every step that follows, from research design to data analysis, becomes a messy and inefficient time-sink.

Tying Your Question to a Business Outcome

Your question must have a direct line to a business goal. This is non-negotiable. It’s what ensures the answers you uncover are genuinely valuable. For instance, understanding how customers describe their problem (your question) is absolutely essential for writing website copy that actually connects (your business outcome).

Founder Moment: I once worked with an agtech startup that was pulling its hair out over slow adoption. They were convinced it was a marketing problem and were about to survey farmers on their favourite social media channels. It was a complete dead end.We helped them reframe their one big question to: "What is the single biggest operational headache our ideal customer faces during planting season that our tech could solve, but currently doesn't?" The answer had nothing to do with marketing channels; it pointed to a critical gap in their product. That one shift in focus gave them a clear path forward.

This structured thinking is becoming more vital than ever. Take the Australian consulting market, where growth is set to accelerate because nearly all clients now have business transformation plans. Half of them are explicitly looking for support to implement those plans. This points to a huge need for clear, actionable insights that come from well-defined questions.

If this feels like a tough first step, that's normal. Most teams struggle here because they haven't been forced to think this way before. It's often where a focused sprint can work wonders, getting everyone aligned on a single, vital objective before a single survey goes out.

Getting this part right is everything. By nailing this one question, you build a solid foundation for all your research, ensuring your efforts lead to confident decisions, not just more data.

Choose Your Method: Talking vs. Tracking

You’ve wrestled with the ambiguity and finally nailed your one big question. That’s a huge step. But it immediately raises the next question: how do you actually get the answer?

This is where many founders get pulled into a vortex of academic terms like ethnography, conjoint analysis, and longitudinal studies. It’s confusing, and frankly, it's enough to make you want to give up.

Let's ditch the jargon. Your choice really boils down to two simple approaches: talking to people or tracking numbers. One gives you the ‘why’, the other gives you the ‘what’.

Talking Gives You the Why

Talking to people, as researchers call it, is all about uncovering the stories, emotions, and hidden context behind a behaviour. It’s about sitting with a potential customer and hearing them describe their frustrations in their own words.

This method isn’t about statistical significance. It’s about depth and discovery. You might only speak to eight people, but those eight conversations can reveal insights a survey of 8,000 never could. It’s how you find out why a certain feature is ignored or why your competitor’s messaging hits closer to home.

Practical Application: An agtech client of ours was struggling to figure out why farmers weren't using a key data-visualisation feature in their app. The analytics showed near-zero engagement but gave no explanation.We set up five on-farm chats. Within two conversations, the answer was blindingly obvious. The sun's glare on the tractor's cab screen made the feature’s colour palette completely unreadable. No amount of data could have told them that.

Talking is your go-to method when you're exploring a new idea, trying to understand a complex problem, or figuring out the exact language your customers use. It adds the human texture that data alone can't provide.

Tracking Gives You the What

On the flip side, tracking numbers or quantitative research is about identifying patterns and measuring scale. It’s what you use to validate the hunches you formed from talking to people. This includes surveys, website analytics from tools like Google Analytics, and your own sales data.

This approach gives you confidence in a specific direction. It helps you answer questions like, “How many people really face this problem?” or “Which of these three pricing plans is most appealing to the market?” It provides the hard evidence you need to make a firm decision.

This decision guide shows how your one big question directly influences the path you take, whether you need to talk, track, or, ideally, do a bit of both.

As you can see, different types of questions, like defining a customer segment versus refining feature priorities, demand different research approaches to get a useful answer.

Deciding between qualitative (talking) and quantitative (tracking) depends entirely on what you're trying to learn. The table below offers a simple way to think about it.

Choosing Your Research Method

When You Need To... | Choose This Method | Because... |

|---|---|---|

Explore a new or vague problem | Qualitative (Talking) | You need to uncover unknown factors and hear the problem in the customer's own words. |

Understand deep motivations and context | Qualitative (Talking) | It reveals the "why" behind behaviours that numbers alone can't explain. |

Test a specific, well-defined hypothesis | Quantitative (Tracking) | You need statistically relevant data to validate your assumptions across a larger group. |

Measure the scale or frequency of an issue | Quantitative (Tracking) | It provides hard numbers to confirm how widespread a problem or preference really is. |

This isn't about one method being "better" than the other. They're different tools for different jobs.

The Real Magic is in the Blend

The most common mistake I see is leaning too heavily on one method.

Founders who love talking can get lost in endless interviews, collecting fascinating stories, but never confirming whether they reflect a wider market reality. On the other hand, data-driven founders can stare at spreadsheets all day, spotting trends but completely misinterpreting the human motivation behind them.

Real clarity comes from blending the two.

You start by talking to a handful of people to form a hypothesis (the ‘why’). Then, you use tracking methods to validate that hypothesis at scale (the ‘what’).

Exploring a new product idea? Start with conversations to deeply understand the problem.

Trying to validate a price point? You’ll need a survey to get enough data for a confident decision.

Noticing a drop-off in your user onboarding? Look at the analytics to see where it occurs, then interview users to find out why.

Most teams struggle here because they treat research as a single, monolithic task rather than a nimble process of asking, learning, and validating. The key isn't to be exhaustive; it's to be resourceful. Just use the simplest method that will give you enough confidence to take the next step.

How to Ask Questions That Get Real Answers

You can have the perfect research method and the ideal audience lined up, but if your questions are off, the entire project is sunk. The quality of your questions dictates the quality of your insights. Bad questions don't just yield useless data; they can give you dangerously misleading answers that send you down the wrong path.

This is a common frustration I see all the time. Teams know they need to talk to customers, but when it comes time actually to write the questions, they freeze up. They end up with a survey full of questions that confirm what they already think, leaving them with shallow, feel-good responses that don't lead to any real breakthroughs.

The root of the problem is that we’re not really taught how to ask questions that uncover the truth. Our natural instinct is to be polite, seek agreement, and avoid awkward pauses. In research, those very instincts are your enemy. Real insight rarely comes from easy agreement; it comes from digging into someone's actual reality.

Stop Asking About the Future

If there's one mistake I see founders make over and over again, it's asking hypothetical questions about the future.

“Would you use a feature like this?”

“How much would you be willing to pay for this?”

“Do you think this is a good idea?”

These questions feel productive, but they're traps. People are terrible at predicting their own future behaviour. They want to be helpful, so they'll almost always say "yes" to these questions, giving you a false sense of security. You walk away feeling validated, only to build something nobody actually ends up using.

You cannot trust what people say they will do. You can only trust what they have done.

The solution? Anchor every single question in past behaviour. The past is concrete. It’s where the evidence lives.

From Vague Guesses to Concrete Stories

To get to that evidence, you need to shift your mindset from asking for opinions to asking for stories. Stories are packed with context, emotion, and detail all the raw materials you need for genuine insight.

Here’s how that small but powerful shift changes the game:

Instead of asking: “Do you like our new feature?”

Ask: “Can you walk me through the last time you used our new feature? Where were you? What were you trying to get done?”

Instead of asking: “Is this problem a high priority for you?”

Ask: “Tell me about the last time you dealt with this problem. What did you try first? How did that work out for you?”

See the difference? The first set of questions begs for a simple ‘yes’ or ‘no’. The second set opens the door to a real narrative. When we embed with a team, this is one of the first things we fix, because changing the question fundamentally alters the research outcome.

Getting this right isn't just about conversation; it's about understanding behaviour, which is why data analytics is becoming so crucial. The Australian data analytics market is projected to skyrocket to USD 7,544.7 million by 2030, driven largely by predictive analytics. For researchers, this trend underscores the need to ground qualitative findings in hard data, providing a much more reliable model for what might happen next. You can learn more about the growth of Australia's data analytics market here.

The Power of “Tell Me More” and Strategic Silence

In a customer interview, your most effective tools are often the simplest ones. When a customer shares something interesting, your first instinct might be to jump in with your next prepared question. Fight that urge.

Instead, try one of these simple prompts:

“Tell me more about that.”

“How did you handle that?”

“What happened next?”

These gentle nudges encourage the other person to go deeper without leading them down a predetermined path. It shows you're actually listening and gives them the space to talk about what’s important to them, not just what’s on your script.

Even more powerful is learning to be comfortable with silence. After you ask a question or after they finish a thought, wait. Count to five in your head. It might feel a little awkward, but more often than not, people will fill that silence with more detailed, less-filtered thoughts. It's in those moments that the real gold is often found.

This kind of structured approach to questioning brings a sense of calm and control to the process. You’re no longer just hoping for a good chat; you have a clear technique for getting beneath the surface and finding the answers that will genuinely guide your business forward.

Finding Meaning in the Mess

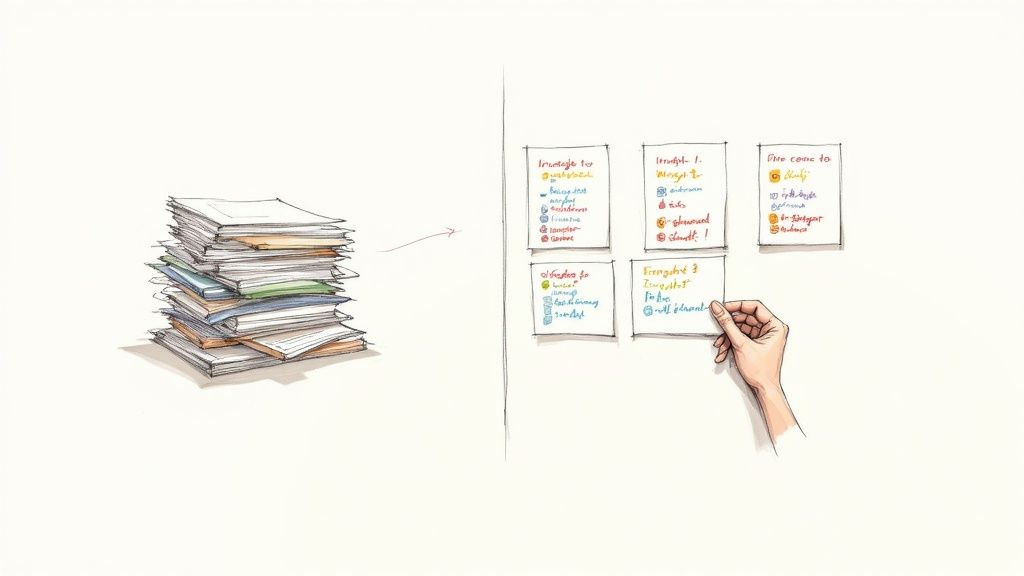

So, you’ve done it. The interviews are wrapped up, the survey is closed, and now you’re staring at a mountain of transcripts, notes, and spreadsheets. This is the exact moment where all that research momentum can grind to a screeching halt.

It feels chaotic, doesn't it? You've got dozens of interview recordings, maybe hundreds of survey responses, and that sinking feeling of being completely overwhelmed. This is where most research projects die,

not in the planning or the fieldwork, but right here, in the messy, confusing analysis phase. It's completely normal to feel stuck.

But here’s the secret: all you're really doing is pattern matching. You're not trying to write an academic thesis. You're simply looking for recurring ideas, surprising contradictions, and the handful of core truths that directly answer your 'one big question'.

From Chaos to Clarity Through Pattern Matching

Look, the goal isn't to create a 50-page report that nobody will read. The real objective is to find three to five core insights that give you the confidence to make your next move. It’s about turning a pile of raw data into a clear direction forward.

This is where having a structured process is a game-changer. Most teams struggle at this point because they get lost in the weeds, focusing on individual data points instead of the big picture.

Here’s a simple, non-intimidating way to get started:

Group the Verbatims: Go through your interview notes and pull out direct quotes that feel important. Don't overthink it. Just copy and paste them onto digital sticky notes I love using Miro or FigJam for this or even physical ones if you prefer.

Cluster by Theme: Now, start moving the sticky notes around. You'll quickly see themes emerge. A bunch of quotes might be about pricing, others about a specific pain point, and another group might mention a competitor. Create a heading for each cluster as you go.

Name the Insight: Once you have your clusters, give each one a proper name. Don't just label it "Pricing Feedback." Try to summarise the core finding in a single sentence, like: "Customers are more frustrated by our confusing pricing tiers than the actual price itself."

This simple act of grouping and naming brings immediate structure to the chaos. It makes the data digestible and helps you finally see the forest for the trees.

Spotting the Insights That Matter

As you sort through all this information, you’re looking for a few key things. Of course, you want to identify recurring themes that validate your assumptions. But what's even more important is spotting the surprising contradictions that challenge them.

These contradictions often hide the biggest opportunities.

Founder Moment: A B2B SaaS company I worked with ran a survey to help prioritise their product roadmap. The results came back loud and clear: 80% of users were clamouring for a complex new reporting feature. The team was ready to spend the entire next quarter building it.But when we dug into the data, we found a fascinating contradiction. The 20% of users who didn't ask for the feature were their most profitable, long-term customers. The big group wanted a nice-to-have, but the high-value group was perfectly happy as they were. This insight didn’t just change their roadmap; it changed their entire understanding of who their ideal customer really was.

This is how you build genuine confidence. It comes from seeing the whole picture, not just what the majority says, but what your most valuable customers do. This is especially true in fast-moving sectors. Australia's online shopping industry, for example, has seen massive growth. Effective research for a company in that space means distinguishing genuine growth from simple price effects, which requires digging into the nuances of customer behaviour. You can explore more about the trends in Australia’s e-commerce sector.

Presenting Your Findings with a Clear ‘So What?’

Once you’ve identified your core insights, the final step is to translate them into action. For every key finding, you must be able to answer two simple questions:

"So what?" (Why does this insight actually matter to the business?)

"What next?" (What is the obvious next step we should take because of it?)

This framework forces you to connect your research directly to business outcomes. It ensures your findings don’t just become interesting trivia but serve as the foundation for a smarter, more confident marketing strategy. For more on this, check out our guide on building a marketing strategy that actually works. It’s this final step that gives your team the momentum it needs to move forward.

Your Calm and Confident Next Step

Look, market research isn't a one-off project you tick off a list. It’s more like a muscle you build over time. The goal isn't to eliminate every last bit of uncertainty; that’s an impossible dream for any founder. It's about consistently chipping away at it, so you can make smarter decisions with more confidence.

If this whole process still feels a bit messy and overwhelming, that’s completely normal. You’re not behind; you need a bit of structure to find your footing. Most teams I’ve worked with struggle here simply because they’ve never had someone show them how to organise the work.

Resist the urge to launch a massive, all-encompassing research project tomorrow. That's just a recipe for getting stuck.

Start by Fixing One Thing

Before you do anything else, go right back to the beginning. Define your single most important question. What’s the one thing you absolutely need to know to unlock your next move?

Get your entire team aligned on that one, specific objective. Maybe it's figuring out how to price your product without guessing. Or perhaps it's pinpointing your most profitable customer segment.

That clarity alone will put you ahead of 90% of your competitors. It's the essential first step toward building real momentum and making progress that actually matters.

This focused approach strips away all the complexity and gives you a clear, manageable starting point. It turns research from a daunting academic exercise into a practical tool for growth.

Once you have that one question, the path forward becomes much simpler. You’ll know who to talk to, what to ask, and how to recognise the answer when you find it. It's how you build confidence, one clear decision at a time.

A Few Lingering Questions

Even with a solid plan, a few questions always pop up before you get started. It's completely normal to have some last-minute uncertainties. Let's walk through some of the most common things founders ask when they’re about to dive into market research.

What's a Reasonable Budget for This?

This really comes down to your company's stage and the specific question you need to answer. When you're just starting out, your biggest investment is your time.

You'd be amazed at what you can learn from just five to ten well-planned customer interviews. These conversations cost you nothing but can deliver game-changing insights. Hold off on expensive agencies or fancy software until you're facing a high-stakes decision that truly needs a large sample size to justify a major investment.

What if I Find Out My Idea Isn't Going to Work?

Honestly? That’s a great result. It might sting for a moment, but discovering this after a few weeks of research is so much better than learning it a year after you’ve built the wrong thing.

This isn't a failure. It’s a gift. It's a critical piece of intel that gives you a clear signal to pivot, saving you a massive amount of time, money, and heartache down the road.

Where Can I Actually Find People to Talk To?

Your own network is a good starting point, think LinkedIn connections or industry groups you're in. Just be mindful of confirmation bias; friends and colleagues often want to be supportive, which can skew their feedback.

For a more objective perspective, you need to go where your ideal customers hang out. Get creative and look for them in their natural habitats.

Specific subreddits that cater to their industry or professional role.

Niche online forums or professional associations that they frequent.

Targeted Slack or Discord communities they’re active in.

A small incentive, like a gift card, can help, but you'll find plenty of people willing to share their thoughts if you're respectful of their time and genuine in your request. The goal is to get real insights, not just tick a box.

If you're tired of guessing and need clarity and structure in your marketing, Sensoriium can help. We step in to untangle the mess, fill in the gaps, and give your business a clear path forward. Find out how we help B2B tech companies grow.